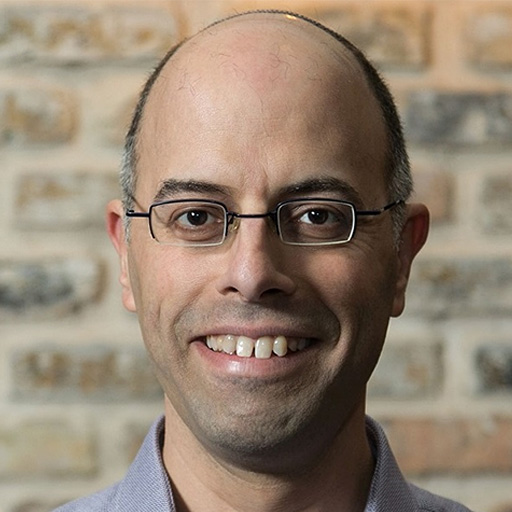

Mark founded ESG Today in 2020 following a 20 year career in investment management and research. Prior to founding ESG Today, he worked at Delaney Capital Management (DCM) in Toronto, Canada as the firm’s head of U.S. equities. Mark also spent several years in the sell-side research industry, covering the technology and services sectors. He holds an MBA from Columbia University in New York, a BBA from the Schulich School of Business at York University in Toronto, and is a CFA charterholder.

John Shegerian: Have you been enjoying our Impact Podcasts and our great guests? Then please give us a thumbs up and leave a five-star review on iTunes, Google Play, or, wherever you consume your favorite podcast. This edition of the Impact Podcast is brought to you by ERI. ERI has a mission to protect people, the planet, and your privacy and is the largest fully integrated IT and electronics asset disposition provider, and cybersecurity-focused hardware destruction company in the United States and maybe even the world. For more information on how ERI can help your business properly dispose of outdated electronic hardware devices, please visit eridirect.com. This episode of the Impact Podcast is brought to you by Closed Loop partners. Closed Loop Partners is a leading circular economy investor in the United States with an extensive network of fortune 500 corporate investors’ family offices, institutional investors, industry experts, and, Impact partners. The Closed Loops platform spans the arc of capital from venture capital to private equity— bridging gaps, and fostering synergies to scale the circular economy. To find Closed Loop Partners, please go to www.closedlooppartners.com. Welcome to another edition of the Impact Podcast. I’m John Shegerian and we’re so delighted to have you with us today, Mark Segal. He’s the founder and CEO of ESG today. Welcome to the Impact Podcast, Mark.

Mark Segal: Thanks, John. It’s great to be here, really exciting. Thanks.

John: You know, Mark before we get going to your wonderful online, you know, newsletter publication, whatever you want to term it. I just want to say, first of all, one of the real reasons I was so excited to have you on the show today is because I’m a huge fan. You’re doing great and important work at a very, very critical juncture in the world’s history in terms of climate change, in terms of circular economy, and the shift from the linear to a circular economy. And I just think what you’re publishing on a regular basis is super important and critical to help educate the world about the importance of this shift. The shifts that we’re undergoing right now.

Mark: Well, thanks. Thank you so much. I mean, it’s as great to hear. Honestly, it’s gratifying to hear that, you know, this crazy idea that I had actually draws attention and draws readers. Some people actually get something out of it. So, that’s wonderful to hear, thank you.

John: Our team gets a lot out of it, all of us subscribe to it, and we’ll go more into a little while, but before we get talking about ESG today, I’d love to hear about Mark Segal. Mark, where did you grow up? You have a fascinating background. Where did you grow up? Where do you get educated? And how do you even get to this position?

Mark: Okay, so I grew up and spend most of my life in Canada— grove in Toronto. I went to school there. I went to York University and did the Schulich School of Business during my undergrad there. And then, from there, I went to the investment world. That world for a few years in investment banks, and sell-side research, then I spent a few years in the States. I went to New York. I did my MBA at Columbia University— Columbia Business School and then I returned again, back to the investment World. Spend a little time or a little more time on sell-side research covering technology software but then the bulk of my career actually was spent in investment management. You know, the 15 years before I started ESG today, I worked for a fund manager in Toronto called Delaney Capital but that two billion dollar fund. I was there when there had US equities, at least for the last few years that I was there. About eight years ago now, I moved to Israel where I live now in a town called Widin. I continue to actually work in Canada for the first six years that I was here. I was actually commuting back and forth, overseas everyone.

John: Wow.

Mark: It was tough but I got a lot of pretty good frequent flyer points and lots and lots of airline status. So you know there’s an upside.

John: Right. Sure.

Mark: And then about three years ago, I started ESG today so.

John: What was the ‘Aha!’ moment when you were, historically, a banker? What was- where do you think that, why didn’t you think there was white space in the market for a regular publication on the issue of the topic of ESG? Where was your, you know, how did you connect the dots and where was your ‘Aha!’ moment?

Mark: Yeah, I’d like to say it was some flash of inspiration where I saw the next big thing, but it was all the opposite. It was- I was- I essentially filled a need that I felt myself. As I said, you know, in the years before I started it, I was working as an investor, right? And I was not an ESG investor, I was a generalist investor focusing on everything; US equities, like every sector, energy, as much as technology. As much as consumers, everything. ESG was not a focus at all. Honestly, I couldn’t have spelled it for you if you’d asked me 10 years ago, but you know, at the same time, you know, responsible investing was always something that we were generally interested in, but more for the sense of risk management, more from the sense of, you know, it’s always good to know who’s running your companies. Make sure they’re not doing sketchy things, but it was very, very vague and just more of a, almost a notion or feeling. Then, anything really codified or, specific. About, I don’t know, I would say five or six years ago, like I’m pretty, pretty late into my tenure, met the firm. We started hearing more about ESG. Again, I would love to say that we were sort of on top of it first. And we went to our clients and said, “Oh, you know, the next big thing is,” but it was really the opposite. We really found that our clients were coming to us and saying, “Oh, you know, my friend said, you know, tell me something about ESG investing. Can you tell me more about it? Can you tell me how my portfolios are aligned with it?” All those kinds of questions and what was interesting is, we found that very often, they didn’t even know what they were asking. They just knew that it was something new and important. And, you know, honestly, I think the ideas like, you know, environmental sustainability, human rights, I think those resonate pretty well, right? They aren’t at least at a high level or not hard to explain and explain why they can be important. Then it really started as a trickle. You know, we manage money for some charitable foundations then institutionally, that as well as prime. Well, and I’m really starting to, you know, sort of like on the foundation site where the, I guess, you know, they would be much more interested in the responsible investing site. But it really quickly, really rapidly spread to frequent questions all the time. And, you know, it kind of sent us like etcetera, I’d swing a little bit like we really had to go back and look at our portfolios in an entirely new light. As an investor, what you usually do when you have like a new topic or new area of investment, is going to read, right? He spent 95% of my time in the investment world reading and researching. So that’s what we did here. If we’re okay, let’s go hit the whoops, and find out what ESG stuff’s all about. As opposed to anything else that we did research before, at least for me, it was much more difficult, much, much tougher. We were used to looking at you know, annual reports and like digging up numbers or looking at industry research. There was nothing, or, nothing substantive, right? I mean, some companies especially the bigger ones, as we’re starting to get wind of the fact that they haven’t talked about this stuff. So they put out the equivalent, you see in the 1980s of the glossy annual financial reports. They would do the equivalent of that on sustainability. Basically, say anything they wanted. Basically, highlight only the things that are great. “Oh, look what we did. Look at the charities that we’re funding,” which is all well and good. But the ability to compare companies or industries was almost impossible. And I went from, you know, spending you know 5% of my time on the sustainability NHT to like 50. It was really totally, and completely time-consuming and, you know, on one hand, it was a little frustrating as I didn’t get to do the stuff I would normally do, all financial analysis. On the other hand, I actually found it really interesting, right? So when I left I figured, you know, it would be interesting to sort of go back and see instead of like, you know, going back to another man, firm, in Israel or doing something, you know, investment for maybe, you know, take a look at my old life. Take a pain point and see if I can solve it, right? Which is what I did. So, I thought, “Okay, it’s got to be something ESG. So what can I do with ESG?” I sort of pictured myself coming into my office every morning. What I would normally do was, I’d say, “Okay. I would generalize so I have to know everything that’s going on in, you know, these ten things. I have to know what’s going on and you know, the energy world and if there have ever been any important, regulatory announcements, whatever.” I thought it’d be kind of cool to be if there is something like that for ESG. If there was somewhere I could go for 15 minutes a day, sort of see what the key topics were that were important over the last few days. See, what other investors are doing, or, where capital is flowing, or what sort of disclosure requirements companies are going to have. Anything. But you know this is sort of guide to saying what’s important in the ESG sustainability world, right now, as an investor. And you know, what do I need to know? You know, what companies are on top, and what companies aren’t? You know, all of them to sort of have like, you know, a quick, easily digestible new source. As I said, I started it as an investor focus because that was the voice that I have spoken. But as soon as I did that I had, you know, I found- once I started getting popular, it really went way beyond investors, and, companies were really interested. Companies were actually having to report on this stuff. We’re very interested, interests of themselves, and because they were getting approached by investors who wanted, who are suddenly demanding new things from them. They want to know what their investors were going to be asking. What banks are going to be asking them? They were getting more questions from their other stakeholders or either from all those guys. They want to know what their peers were doing. So I kind of shifted gears a little bit to kind of speaking about both sides. You know, what investors want, what companies are looking at. So it’s really kind of brought focus right now which is you know a bit tough. I might have to let you know, hire a little more staff to cover everything but you know, admittedly, I guess in a long-form answer. That’s where I am right out.

John: You know, about the real, I’m really lucky to have this show because I started this show 15 or 16 years ago— 2007, just to have folks like you on but what always amazes me, is once I got turned on to your great, you know, publication and get for our listeners and viewers who want to find Mark’s great publication called ESG today, very simple. Just go to www.esgtoday.com. Download it, subscribe to it, and read it, you’ll love it. Do you know, Mark, I was in shock once I read the first couple of editions that no one’s done it. It was so comprehensive. First of all, what you were doing, then I said, “What a brilliant guy this is! I got him on the show because where’s this thing been? How are there not tens of these, or, five of these, or three of these? We dived and saw in the form that you did it which was just so- it’s so well done. So you launched this in 2020 which is really the beginning of the pandemic. Talked about being an entrepreneur. Now, you leave a banking job, I take it. I think you thought about this for some time. And five or six years ago, you said you came up with the idea that you started planning on it. Did you fully cut ties with the banking world when you launch this in 2020?

Mark: Yeah, it was really, I mean, this is full-time, right?

John: Right.

Mark: This is more than full-time. This is like 20% full-time. So yeah, I mean, it’s a funny thing in the sense that I still feel like I’m a professional investor even though I haven’t done it in years. But you know, in an interesting way when I started, when my experience in the investment world, at least the part that I was in, is that it’s very insular. You know, like, I mean, you act like you build advantage by knowing things that other people don’t know, or figuring things out the other people don’t know. So your discussions with peers, I mean, outside of your office, your discussion with peers in the industry are kind of limited. And it’s always interesting to meet people who knew what you’re doing, but it’s not that collaborative, you know? I mean, I met and knew other people that I would see at conferences and stuff and, you know, beyond a sort of, you know, “Hey, how you doing?” basis. But I found that after I started doing this, being a provider of information instead of older information, I find that, you know, I’m much more involved in the investment world than I ever was before, which is sort of interesting.

John: Wow. It’s ironic actually.

Mark: It’s ironic, right? Initially, before I become part of it, I didn’t know anybody. Now…

John: Yeah. Now, you’re the bread that every baker wants to know.

Mark: Yeah.

John: So when you launched it, the pan- You launched it before the pandemic, yeah, I take it.

Mark: Before it, just before, which I got to say was a very good time to start a home-based business.

John: Yeah, tried right? You picked a great time for being like, I didn’t have an office or anything working out of your home was a brilliant idea, I guess. So how’s it been? Talk about the journey. Talk about what you share, with what you expected that happened. Please share what you also were unexpected that happened during the last two years of being an entrepreneur now instead of a banker.

Mark: That’s a fantastic question. I didn’t expect it to take off the way that it did. I was hoping that it would but I know I’ve met enough in-trouble entrepreneurs that I know, okay, you know, everyone out of five, ten, and three, I don’t know, really works but I figured out. Look, I’ll give it a shot for a few months. I’ll see if anyone noticed, right? So I polish for a few months and like, “Oh!” you know. I actually got some traffic, it’s kind of interesting. I got my first advertising client, shockingly, but three months after I started publishing which surprised me. I thought you know, I was trying to think of a marketing plan that goes door-to-door then someone actually showed up and said, “Oh hey, I’ve seen your site, do you mind if I advertise on it?” That was that. That was shocking, right?

John: Does your marketing plan- There’s your marketing plan, you had an open great publication, how a lot of people thinking about it and reading it, then people want to advertise on it.

Mark: Yeah, that was both gratifying and relieving because it’s sort of getting the sense for the first time that. Okay, this is actually something I can do professionally. And it is building something out of it which is, well, you know, financially sustainable which is nice. But more than that, the idea of actually just building something, which I never really had the chance to do before. You know, it’s gratifying, rewarding, and, time-consuming like crazy but for the first time in my life, I’m as busy as anything but actually happy about it. And, you know, the more I put into it, the more I get out of it, which is great.

John: How? Okay, so, you know, I used to be in the dotcom world but this was back when I started a dotcom when Google was founded in 1998. I started financialaid.com. So I’ll just go back to some of my old lingo. So talk about scaling, you know, how fast is it scale and where were your viewers the first corner, where your viewers now and, you know, where is this rocket ship going, Mark?

Mark: Right. Yeah, I think I’m still, I hope I am and still in the scaling phase. You know, the thing is, you never know until you’re actually there. I remember- So, okay, let me think. So, when one of my first advertising customers came along, I remember actually, I actually push back a little bit. and I said, “Guys, are you sure you don’t want to wait? You know there’s not, it’s not a whole lot of traffic right now.” But, you know, they said that “I don’t think- you know, we like what you’re doing. We’re happy to support it,” which is fantastic. It was repetitive. It is drastically there and there. I used to be a client of theirs, which they didn’t know when they came to me. They’ve been bought by London Stock Exchange since then. But we’re still in tight with a fantastic life. But anyways, so they came along. I think I told them that you know, I’d managed to get like 20,000 hits on the site by that point. You know, it was pretty early on which is really exciting for me. That’s all, that’s like you know, 20,000 people actually clicked on it. You know, amazing.

John: Right.

Mark: Now, you know, on a good day, I get that. So that’s really nice.

John: That’s great.

Mark: Yeah. So scaled really nicely, you know. I’m not quite there every day but you know, we’re probably 300,000 page views a month which is- and then growing really quickly. I started a newsletter a little- I didn’t do it right away but I started it a little while after because I thought that might be an interesting thing to do and that became very popular. That kind of moved up to about 25,000 subscribers, pretty quickly, 145,000 LinkedIn subscribers which is great. It’s just really gratifying that, you know, to actually see people interested and engaged in this stuff.

John: Give our listeners and viewers, a little glimpse of where this whole trend of ESG and circular economy is going, Mark. What’s getting the most traffic on your site and on your great publication, what are your viewers most interested in? In what topics are your viewers and readers most interested right now?

Mark: Yeah. Okay. So I think far above anything else, are the company’s investors, both of them are really interested in what their obligations are going to be in the next few years, particularly relating to where regulators are going. Any time, I write anything with the word disclosure or climate reporting in the headline, it’s immensely popular. I mean, I’ll also point out where I stick anywhere to the lug, no I’m just kidding, but that is, by far top of mind for companies and investors. I mean every regulator in every major market, is either, you know, coming up with the rules that companies are going to have to provide reporting on climate risk, on their climate plan, especially on climate right now, on climate plans. Some on broader sustainability risks that go beyond the limit by diversity rights, everything, you know, governance, everything else, but certainly in those topics, the SEC in the middle of doing it, the EU just adopted there. That’s one of my top-performing articles of all time when they adopted their CSRD you know, sustainability according to rules.

John: Right.

Mark: Anything like that is very, very top of mind and drives more traffic, more interest, and more feedback than anything. Related to that, and not surprisingly our articles have to do with tools to meet those obligations, right? I kind of see the separate topics, but they’re obviously clearly related. I mean, I did an article a while ago and I think it was about a report that ENY had put out night called to whoever was, who put it out. It wasn’t him, we’re certain it was him. They’d spoken to a bunch of CFOs in companies and asked them, “Where were you on getting ready for sustainability reporting?” Because this stuff is really serious, really detailed, and very data-intensive and they said that over half of them were storing all their information on spreadsheets which I found to just be a shocking statistic and you know these things take a lot more than spreadsheets, right? I mean, there is going to be half, there’s going to have to be a massive investment in tools and data tools. Everything from AI to information management to reporting software to tools that actually record, you know, what type of missions companies have and, you know, supply chain tools to find out what’s going on and what your suppliers are doing? This is men’s stuff and I think the investment has just started and companies’ investors are really aware of that. They know they have big obligations coming up. I think I believe if the SEC put out a study a few months ago saying, you know, estimating what company you’re going to have to spend on average to actually meet it and it was a lot. It was pretty- I wish I can remember off the top of my head what it was. But you know, these are all big things coming and it’s not just a matter of investing in tools, it’s a matter of investing in people, right?

John: Right.

Mark: It’ll just be like you have a CFO office. Now, you have achieved sustainability officer office.

John: Right.

Mark: But they’re going to have sort of like meet. There’s going to have to be somewhere in the middle because you know, CSOs and sustainability officers aren’t typically reporters. They don’t have the financial reporting discipline that, you know, accountants and CFOs do. So there’s going to be a massive investment in people, tools, and everything. So that is extremely popular as well. Other things that I think are really popular. You know, I write about a lot about, you know, just general about sustainability commitments or achievements that companies are doing it because A- it just kind of feels good and you know I say though, generate different demand, different amounts of interest I find. If there are things that other companies are thinking about doing it. It really resonates every once in a while something just really, really hits. A topic recently that I’ve discovered writing in the last couple of months that has gained more popularity in terms of readership, more rapidly than anything I’d seen before is the anti-ESG political movement in the U-, which I think is far as I can tell, pretty much contained in red states in the US. But whether it’s serious or not, it’s making a lot of noise and getting a lot of interest, and people are just getting really riled up, you know, on both sides of it. On the one hand, obviously, I have a passion for ESG. So anything that fights against it, you know, kind of rubs me the wrong way, on the other hand, from a pure business perspective it’s really working for me because it’s a big traffic generator but that is definitely like you know, topic of the day.

John: Well, also, you’re reporting the news, producing the news, isn’t that right? You know, even though you, of course, are pro-ESG it sounds like, obviously that a little bit of conflict, never really hurt any news organization, right? And, you know, I do my best to be as objective as possible just to report the facts. And then, this is certainly, you know, pertinent and material to hang out to the movement in general. For our listeners and viewers who just joined us, we got Mark Segal with us today. He’s the owner and CEO of ESG today. To find Mark, his colleagues, and his great publication and to download it, read it, and subscribe to it, go to www.esgtoday.com. Mark, talk a little bit about your readership, you know. It’s kind of fun as an entrepreneur. When you have a great publication, like, you have to open up the world map and see where your readers truly are, when you open up the world map, what does it look like? Where are you getting the most interest so far? And I know this will probably be evolving as I interview you a year from now or two years from now, but today, where are the majority of your legions of fans?

Mark: You know, you’re right. It’s fascinating to open the map and see like, “Wow.” Like there are people all over the world reading the stuff that I’m writing which is nice, shocking, and fun, right? I would say the audience is probably reflective of the English-speaking business and investment world. Not shocking, I’d say a little, maybe 35, 40%? North America, the US, obviously the other, you know, the biggest. UK and Europe, probably about another third, lots and lots. Asia-pacific, a little bit of South America. Yeah, just all over, there’s Africa. It’s just fascinating. It’s pretty cool demographics. You know, from what I can see just, you know, I guess some, you know, a little bit information on from our newsletter subscribers. It’s a very high-level business audience, I think, the management suites are particularly interested in this like they’re the ones who really have, you know, boards that they answer to and they’re you know, they’re the ones who talk with investors and with regulators. I think around 15% of our subscribers are C-suite, you know. So CEOs, CFOs, and stability officers. You know, once I actually collected that data for the first time it was kind of eye-opening. I thought that was interesting. Another 30%, so almost 50% altogether. Another 3% is you know, Senior Vice President, Vice President, Director. So it’s very, very high level. A pretty big proportion I got to say that their function right in. This is actually really shocking. We’re on the third said that their main- trying to think what the word is, their main function right now is sustainability. So, that’s interesting. It’s, you know, it’s both a high-level audience and the same audience says that they’re heavily involved in sustainability. I thought that was really interesting. Not something I think you’d see five years ago.

John: Right, right, right, that’s interesting. That is interesting. What- when you think about, you know, as you said earlier right now what’s hot is obviously the two sides of the coin of ESG. The little conflicts that are existing right now, like in Texas and other states, as you point out mostly red States, but talk about like the disclosure issues, SEC, what’s Gary Gensler doing in the SEC now? What do you think is- when you crystal ball the next five years, what do you think the hockey pucks going? Not where the puck is today, but now you have two years under your belt of running your great publication and lots of information from lots of really smart folks that you get to talk to and interact with now, on a regular basis. Where do you think this seems like a macro trend is going?

Mark: Wow. Okay, so okay, five years sounds a little scary to me.

John: Three, let’s go to three.

Mark: Okay, so okay, number one I think we’re really just in something that I found really interesting. Just to backtrack a little bit. Yeah, I found it really interesting. Every once in a while, I go and look back at the stuff that I was writing about two years ago. And what I’m writing about now? More than anything, I get a sense that the ESG field has matured a lot since then, right? I mean, I find the stories I was writing back then. You know, the company made some sort of commitment or something. It was a lot vaguer, and a little less ambitious, it just sounded better than it actually was. And I see why. I could see like as an investor back. Then when I say, you know when the company said, “Oh yeah, we’re going to be carbon neutral or something.” I said, “Oh, that’s really interesting. Great.” But you know, as more companies have done it and, you know, it becomes more apparent. That’s actually, you know, that ESG risks and opportunities are actual real investment risks and opportunities. I find investors and regulators are really on top of it and our company has become much more serious. And, you know, you see, you know, goals and actual actions that are much moment surreal. And I think that’s just the beginning. And I think that they, you know, but I wouldn’t call it mature yet but I think it matures much more. I think materiality, the contractor comes into play, in a big way where companies actually focus on the things that matter to them to investors to their actual sustainability efforts. I think that becomes much more apparent when they actually when companies actually have to start reporting according to real standards that they’re going to have to start doing this year next year or the year after that. Right? So I think things grow up in a big way and things get very serious. Now, what I find really interesting is going to happen and I think this is also a function of other things that have just happened in the world. In general, I think now that companies invest in data and information actually up, I’d let you know, and let’s say, you know, supply chains have been a big topic over the last couple of years. As, you know, not specifically from a sustainability point of view, a little bit but much more because the world is in a mess for so long that you know, people really had to like invest in understanding what’s happening in their supply chain and the same time they’re arresting and seeing what’s happening in ESG and I think those things start to come together, right? I think you know, the way that you actually, you know, approach a problem was when you actually when you can actually see it and record on, right? And I think a lot of sustainability risk beyond climate happens in companies’ supply chains, right? Let’s say human rights risk, you’re, you know, if you’re a consumer company and you know, you sell clothes or you sell anything, you know, your supply chain until now has been pretty dark. Now I think the data comes up there, once data’s up there, everyone knows about it, right? Regulators know all about it. Investors know about it, they want to know that there are no human rights problems. They want to know there’s no nothing you know, like slavery, child labor, all of that. So I think, you know, with the maturing of ESG and the availability of data I think things are just exploding because I think like all of a sudden you have all this visibility, all this transparency into things that were totally dark before and a world that’s much more interest. So, you know, I think the next two- in the next three years and, in the next five years, I got over my phobia there. I think things changed dramatically and ESG risk becomes much more important to investment consideration.

John: Obviously, ESG is a broad, broad topic which is great because it gives you lots of subtopics to consider and write about and, your readers and subscribers will be very interested in it. Let’s take out one of the subtopics circular economy, the shift from the linear, or circular economy. What’s the interest level that you see today in your subscriber base right now, on that massive generational shift ha were undergoing as we speak?

Mark: Much higher than it was before, you know, in the beginning, I think people just sort of circular economy, they had a picture in their head of recycling bin and you know, in their office when they had thrown the plastic, I think, again, I think it’s just a matter of the things maturing. I mean honestly, I think people had really heard of circular economy, at least in my circles, no pun intended.

John: Right.

Mark: You know, and until maybe a couple of years ago, and then I started writing about you know, some investors would focus on these guys like Closed Loop, and all those guys. And I find, you know, when I read about them now it’s got a lot more interest than it used to and it’s not just that I’m bigger. So it’s just like it relative to everything else and I think because that fits into so many ESG topics. I mean it really sits at the center of everything. I mean, if you think about it you know like you could draw a line from the circular economy topics, that climate, the biodiversity, even the human rights of the supply chain because I mean if you’re less reliant on going outside for things then you can sort of like you know, you re-use what you have. It just touches everything. So I would say interest is growing and it’s cool to see because it does, it means that people are actually, they’re actually learning. The world’s just much more interesting, which makes my job tougher because it’s me, the expert and stay a step ahead. I’m going to do more reading or studying.

John: Right, right. As an entrepreneur, Mark, you know, when you go to bed at night, what are your top three goals for 2023 in terms of continuing to polish and grow and scale ESG today?

Mark: After another, it’s a great and scary question, you know, I feel that you know, like I said, I’m kind of in the middle, I hope of scaling, right? I mean, I think I’ve already, a few months ago I saw it reach the point where, okay, this is a real business, right? It’s sustainable. I can keep it going, you know, and I felt like I have kind of hit the point where I can officially say that I have like, you know, a media platform. Okay, maybe not a huge one, but something is actually, you know, put things on top, right to build on top. So then, you know, we kind of wonder what you do from there? Like, what can you build on top of this platform? And I’m kind of exploring that right now. I mean, little things that just, you know, little things I can add to the site that I don’t have the author in there now you know. I do a lot of work, make a lot of our advertising clients like, have events that they do that they want to advertise or a lot of like materials that they want to know. The things that I can do to host or drive people towards words, you know, towards their events and towards the material, you know, maybe one day I could do my own events, I think, you know, ESG today presents.

John: Conference at ESG.

Mark: Get out of something…

John: Conference at ESG with all the basic cheap experts in the world.

Mark: Right and for the first time, like just I’m starting to get a lot of questions like, “Oh hey, would you consider a conference?” Honestly, it scares the pants off of me because I’ve worked on conferences before and I know what it involves. But yeah, I built a little bit of staff. I think it’s doable. I think, you know, I kind of locked into the topic that’s really just in its infancy and I love the prospect of growing my business with it. As it matures, we mature, and we can do like so much more, right?

John: Let’s say in the growing topic you know, the individual verticals are becoming more important. I think there is a lot to do.

Mark: Speaking of growing a business, and I agree with you, lots to do, and I think you’re going to just I think you’re going to explode in the coming years just like the topic is going to continue to explode and the importance of it. How many employees do you have now working for you?

John: Okay, it’s a little embarrassingly, small.

Mark: That’s not- actually it’s impressive. The smaller it is, the better. The more everyone thinks, the more you’re even better, better, genius, and a better entrepreneur than it seems like I think.

John: So, there’s me obviously, I do a good chunk of the writing honestly. I’d like to like maybe build my writing staff a little more, so I can do a little more, this and that and a little more management but actually, I do enjoy the writing. So part of that is just an excuse. I mean, I actually enjoyed it. I have one dedicated writer aside from myself, my wife— who’s a CPA, decided that I see you like that. I was up till 3:00 in the morning every day anymore. So she said, “Okay, I’m taking over the back office though.” So it’s like, she’s on the payroll now.

Mark: Yeah. I love it.

John: So they’re just, I just thought I decided to- I’m sorry where are we at? When you are a banker, did you know you were this good of a writer and this prolific, was that one of your love skills then, or?…

Mark: I got horny. I sort of hit my maximum flattery level. So that’s it.

John: Yeah, okay, good.

Mark: I did have to write it for a bit and I’ve always enjoyed it. So I didn’t know if it was any good or not. But yeah, I’ve come to realize more over the last couple of years, you know, what a skillet is, And, I didn’t realize that it’s nice to see that I can actually do it in a way that’s meaningful to people. I don’t think I’m the best writer, but I think I’m good enough, especially with the type of stuff I do. It’s very business-oriented so punchy and fast and not like a flower you elaborate, so I’m pretty good at that. Honestly, so other than that, I’m just hired for a media specialist to work on that on those things that are talking about, you know, like what can I put on top of the platform. I have one, I have like a web developer like on its kind of contract basis and that’s it. That’s us.

John: So let’s- you know, going back, I just want to ask a question. When you are a banker, you never invested in a publishing company before, right? So, publishing was very new to you.

Mark: I knew absolutely nothing about media.

John: So let’s hold that thought and then also talk about the internet, you weren’t a dotcom specialist. You didn’t even have a lot of dotcom specialists where the CEOs, informed you about being a dotcom entrepreneur either, right?

Mark: No. I was a value investor, so that was the first.

John: Right. So isn’t that interesting? You know, people ask me all the time about this. I just want to ask you a few thoughts on this. Being now, an entrepreneur and a successful one obviously, ESG today, is already a success. It’s already taking in advertising dollars. So it’s a business. You got a business on your hands, that’s a success. Is there something to not having experience in you’re given a choice of entrepreneurship opportunity than already having some experience and going in with predisposed notions?

Mark: Wow, what a fascinating idea. Yeah, I mean it’s funny I didn’t even think about the fact that I didn’t know anything about the- it didn’t even occur to me until the- I think sometimes the less you know, right? The less scary something is.

John: Right!

Mark: After six months, I’m like, “Oh well, it would have been really smart if I had done that, but I sort of fixed this problem.” Then again, you know, and I’m still doing that, right? I talk to marketing people all the time now and I still don’t speak the language at all. So I had to like go to friends of my mine to translate. But yeah, I think I’m not sure if I would have done it if I had not if I sort of looked.

John: Right.

Mark: I’m a bit, you know, skeptical in it by nature which I think kind of made me a good and very cautious investor and but you know, kind of insufferable, you know, to my family because I’m always thinking, what if, what if, what if, right? I mean, I heat up.

John: Yeah.

Mark: My anxiety levels are usually here and going into something where I didn’t know what could go wrong and I think that was really awful.

John: That’s us, you know we have a lot of young entrepreneurs around the world who want to be entrepreneurs around the world that listen to our podcast, what pearls of wisdom you have for them now in terms of starting their own business and being disruptive, and going to something that could really make a difference as well as make a profit.

Mark: Well first, you know, absolutely find something that’s interesting to you, right? I mean like I said, the reason that I started doing ESG today is A, because, you know, it’s all the pain point and I thought it was, you know, I thought I saw there were the words made people doing it and all that, but more than anything I spend so much time on it at my last job and I found it more interesting than all the other stuff I’ve been doing. So it was something I really felt that, okay, if I’m going to be pouring, you know, I want to see how many hours a week does. It’s a little bit embarrassing but if I’m going to be dedicating all my time and like a sleepover something, it better be something that I’m interested in.

John: Right.

Mark: So, you know meeting that confluence point of something that’s interesting, as I mean, no one else is doing, and something that has value to people I think was very important. Look, I mean, I thought won’t be interrupted for a long time. I worked for somebody for the first, you know, 20 years of my career. I thought it’d be interesting and but, you know, but when I finally got that spark, I said, “Oh, you know, here’s something that I can do that I like, that I think to be valued and valuable to somebody else. That’s when I really decided to dive into it. So that would be my number one, make sure, you know, obviously, make sure that it’s interesting to other people or something that people are interested in, but make sure it’s interesting to you because, you know, okay. I was gonna say that, you know, like, I don’t know how much awareness I brought to the market, I’m not going to oversell, you know, what I’ve done, but it’s also really gratified to do something where I feel that I’m actually making some bit of difference in the world, to make the world better which is great. In my old job, I felt that a little bit. We were helping people invest and save as a retirement but there was something in the back of my head that always kind of said, like, “You know, are you really doing something valuable? Is the world a better place because of you?” I could say yes, but I had to convince myself a little bit and now you know, it’s nice to really feel good about the things that you’re doing. So, you know, I think that’s where I’m used.

John: Well, Mark, like I said we’re going to have you back on the show to continue to share your wonderful journey. Where’s the best place our audience can find you and your ESG today and where can they connect with you? One of the best places is LinkedIn, esgtoday.com, and where else?

Mark: Yeah, to get ESG today, just go to esgtoday.com. All right. We have a daily newsletter or almost daily newsletter that we send out. So that’s a great place to, you know, just keep them the news flow. To reach me, I do a lot of communication on LinkedIn. That’s a great place to reach out.

John: Perfect. Well, I wish you continued success in your wonderful journey. Thank you, Mark, for making the world a better place, and making a big impact. Thank you for polishing ESG today, and again for our listeners or viewers, www.esgtoday.com. Mark Segal, you’re a great entrepreneur. You’re making an important impact and we wish you continued success. We hope you come back to the Impact Podcast. Another time to continue your shared journey.

Mark: Thanks, I’d love to come back. I really enjoyed it. Thank you.

John: This edition of the Impact Podcast is brought to you by Engage. Engage as a digital booking platform revolutionizing the talent booking industry with thousands of athletes, celebrities, entrepreneurs, and business leaders. Engage is the go-to spot for booking talent, for speeches, custom experiences, live streams, and much more. For more information on Engage or to book talent today, visit letsengage.com. This edition of the Impact Podcast is brought to you by ERI. ERI has a mission to protect people, the planet, and your privacy and is the largest fully integrated IT and electronics asset disposition provider, and cybersecurity-focused hardware destruction company in the United States and maybe even the world. For more information on how ERI can help your business properly dispose of outdated electronic hardware devices, please visit eridirect.com.